UT Bot is a very popular script in my TradingView account. Quite a few people asked me to translate it to another programming languages. I already created a version in Python. In this article I’ll show you a way to implement UT Bot strategy in EasyLanguage for TradeStation. I started to look more into TradeStation because of the automation and screener features of TradeStation. nNew

To create a new script in TradeStation click on EasyLaguage button on the TradeStation dashboard:

Writing the code

Create new strategy and you can start coding. First let’s define parameters for our script. We need only 3 parameters: Price source, sensitivity of the algorithm and ATR length.

inputs:

Price( Close ) [DisplayName = "Price"],

sens( 1 ) [DisplayName = "Sensitivity"],

atr_len( 10 ) [DisplayName = "ATR Length"];

Next we have to defined all the variables we’ll be using in the script:

variables:

xATR( 0 ),

nLoss (0),

xATRTrailingStop(0),

cur_pos(0),

above_sig(false),

below_sig(false),

buy_sig(false),

sell_sig(false);

Next we’ll compute ATR and nLoss (trailing value) variables:

xATR = average(TrueRange, atr_len);

nLoss = sens * xATR;

Now let’s compute trailing price, because of EasyLanguages if’s it looks a bit bulky:

if Price > xATRTrailingStop[1] and Price[1] > xATRTrailingStop[1] then

xATRTrailingStop = Maxlist(xATRTrailingStop[1], Price - nLoss)

else begin

if Price < xATRTrailingStop[1] and Price[1] < xATRTrailingStop[1] then

xATRTrailingStop = Minlist(xATRTrailingStop[1], Price + nLoss)

else begin

if Price > xATRTrailingStop[1] then

xATRTrailingStop = Price - nLoss

else

xATRTrailingStop = Price + nLoss;

end;

end;

Next let’s compute a variable that will store current position of the strategy. 1 -> Long, -1 -> Short, 0 – Flat

if Price[1] < xATRTrailingStop[1] and Price > xATRTrailingStop[1] then

cur_pos = 1

else begin

if Price[1] > xATRTrailingStop[1] and Price < xATRTrailingStop[1] then

cur_pos = -1

else

cur_pos = 0;

end;

Now let’s compute buy and sell signals, their logic is pretty simple:

above_sig = Price >= xATRTrailingStop and Price[1] < xATRTrailingStop[1];

below_sig = xATRTrailingStop >= Price and xATRTrailingStop[1] < Price[1];

buy_sig = Price > xATRTrailingStop and above_sig;

sell_sig = Price < xATRTrailingStop and below_sig;

The last thing is to trigger orders. You can see that code for orders looks almost like a human language:

if sell_sig then

SellShort ( !( "UT_BOT_SE" ) ) next bar at market;

if buy_sig then

BuyToCover ( !( "UT_BOT_SX" ) ) next bar at market;

if buy_sig then

Buy ( !( "UT_BOT_LE" ) ) next bar at market;

if sell_sig then

Sell ( !( "UT_BOT_" ) ) next bar at market;

Next save your script and validate it. If you won’t see any errors then we’re ready to apply it to your chart:

Backtesting Strategy

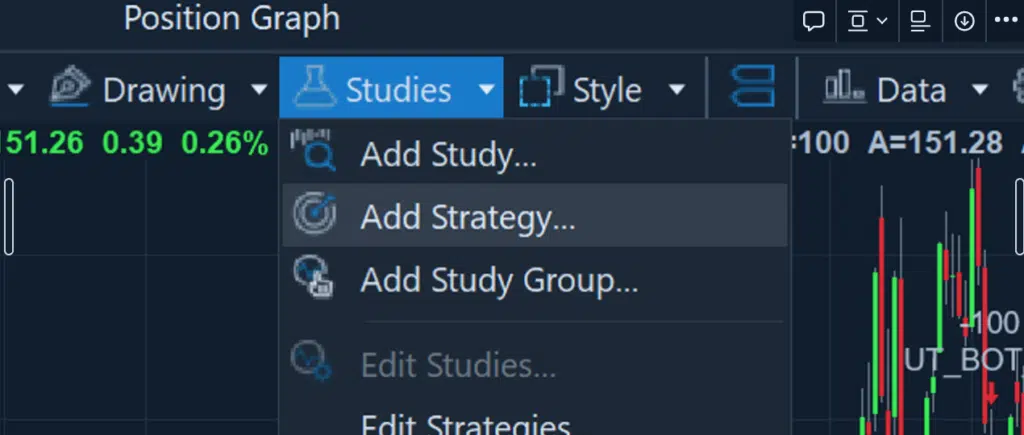

To apply your strategy to your current chart you can click Studies -> Add Strategy. Find the name of your strategy and add it.

After that you should see orders plotted on your screen:

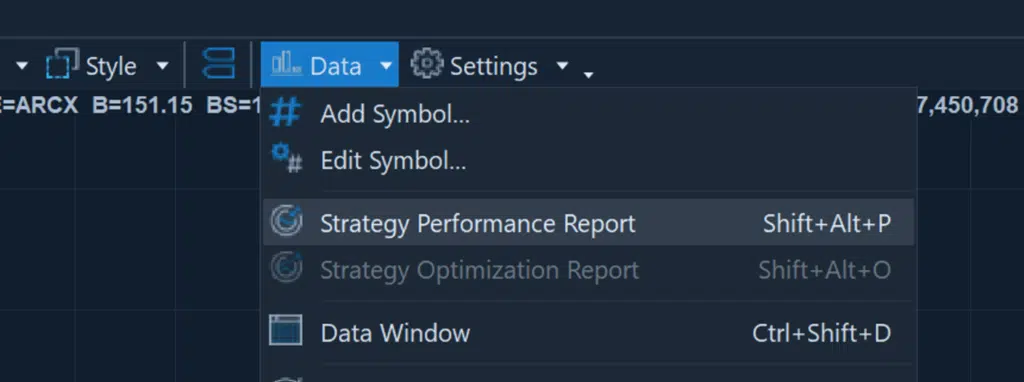

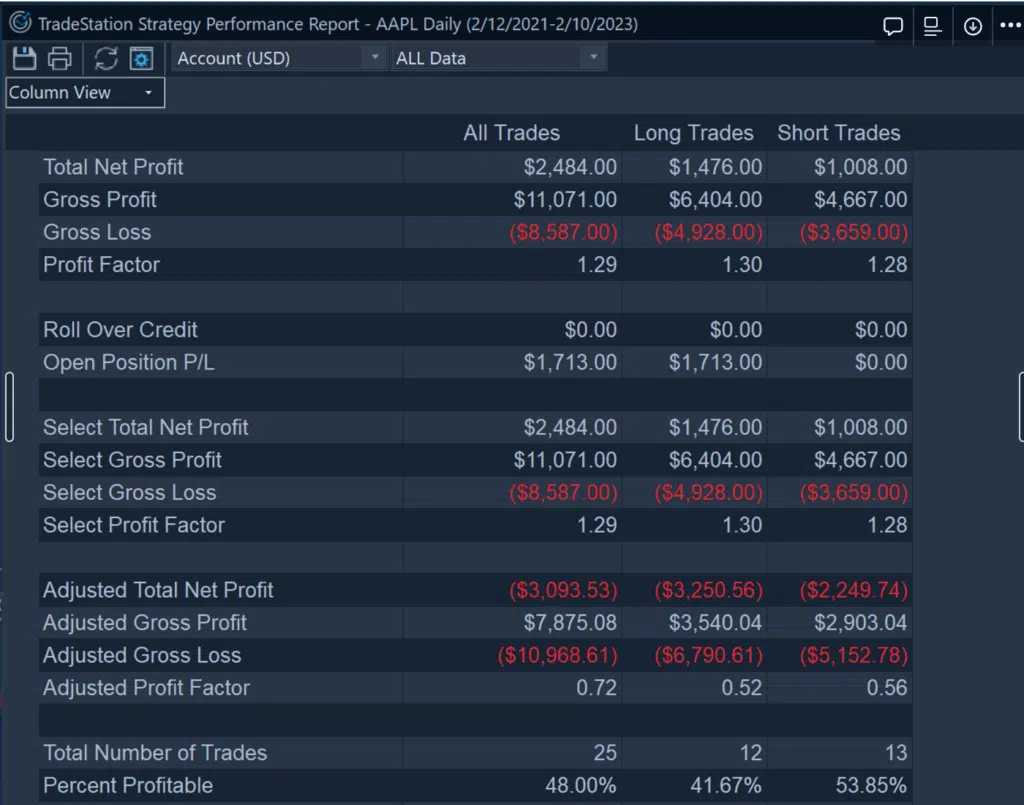

To see strategy performance you can click Data -> Strategy Performance report:

You should see performance like that in a popup:

Entire code used in this article:

inputs:

Price( Close ) [DisplayName = "Price"],

sens( 1 ) [DisplayName = "Sensitivity"],

atr_len( 10 ) [DisplayName = "ATR Length"];

variables:

xATR( 0 ),

nLoss (0),

xATRTrailingStop(0),

cur_pos(0),

above_sig(false),

below_sig(false),

buy_sig(false),

sell_sig(false);

xATR = average(TrueRange, atr_len);

nLoss = sens * xATR;

if Price > xATRTrailingStop[1] and Price[1] > xATRTrailingStop[1] then

xATRTrailingStop = Maxlist(xATRTrailingStop[1], Price - nLoss)

else begin

if Price < xATRTrailingStop[1] and Price[1] < xATRTrailingStop[1] then

xATRTrailingStop = Minlist(xATRTrailingStop[1], Price + nLoss)

else begin

if Price > xATRTrailingStop[1] then

xATRTrailingStop = Price - nLoss

else

xATRTrailingStop = Price + nLoss;

end;

end;

if Price[1] < xATRTrailingStop[1] and Price > xATRTrailingStop[1] then

cur_pos = 1

else begin

if Price[1] > xATRTrailingStop[1] and Price < xATRTrailingStop[1] then

cur_pos = -1

else

cur_pos = 0;

end;

above_sig = Price >= xATRTrailingStop and Price[1] < xATRTrailingStop[1];

below_sig = xATRTrailingStop >= Price and xATRTrailingStop[1] < Price[1];

buy_sig = Price > xATRTrailingStop and above_sig;

sell_sig = Price < xATRTrailingStop and below_sig;

if sell_sig then

SellShort ( !( "UT_BOT_SE" ) ) next bar at market;

if buy_sig then

BuyToCover ( !( "UT_BOT_SX" ) ) next bar at market;

if buy_sig then

Buy ( !( "UT_BOT_LE" ) ) next bar at market;

if sell_sig then

Sell ( !( "UT_BOT_" ) ) next bar at market;

Follow me on TradingView and YouTube.