UT Bot Strategy is one of the most popular scripts I published on TradingView. I was asked many time if I have a version of this strategy in Python. Recently I started using vectorbt and I decided finally to implement this strategy in Python.

First let’s import all the libraries we’ll use in this code:

import vectorbt as vbt

import pandas as pd

import numpy as np

import talib

import datetime as dt

URL = 'https://api.binance.com/api/v3/klines'

intervals_to_secs = {

'1m':60,

'3m':180,

'5m':300,

'15m':900,

'30m':1800,

'1h':3600,

'2h':7200,

'4h':14400,

'6h':21600,

'8h':28800,

'12h':43200,

'1d':86400,

'3d':259200,

'1w':604800,

'1M':2592000

}

def download_kline_data(start: dt.datetime, end:dt.datetime ,ticker:str, interval:str)-> pd.DataFrame:

start = int(start.timestamp()*1000)

end = int(end.timestamp()*1000)

full_data = pd.DataFrame()

while start < end:

par = {'symbol': ticker, 'interval': interval, 'startTime': str(start), 'endTime': str(end), 'limit':1000}

data = pd.DataFrame(json.loads(requests.get(URL, params= par).text))

data.index = [dt.datetime.fromtimestamp(x/1000.0) for x in data.iloc[:,0]]

data=data.astype(float)

full_data = pd.concat([full_data,data])

start+=intervals_to_secs[interval]*1000*1000

full_data.columns = ['Datetime', 'Open', 'High', 'Low', 'Close', 'Volume','Close_time', 'Qav', 'Num_trades','Taker_base_vol', 'Taker_quote_vol', 'Ignore']

return full_data

I’m importing vectorbt, pandas and numpy for some custom computations, binance api to get the candles for the backtest and talib for access to technical indicators in Python.

Next let’s define the parameters I want to use for my backtest. If you want to change any parameters for your backtest change them here:

# UT Bot Parameters

SENSITIVITY = 1

ATR_PERIOD = 10

# Ticker and timeframe

TICKER = "BTCUSDT"

INTERVAL = "1d"

# Backtest start/end date

START = dt.datetime(2017,8,17)

END = dt.datetime.now()

Next let’s import data from Binance, with library I imported you can do it with 1 line of code:

# Get data from Binance

pd_data = download_kline_data(START, END, TICKER, INTERVAL)

Next I’ll compute ATR and NLoss variables. I’m using ATR function from TA lib to compute average true range, there are many other useful technical indicators available in this lib. Also I’ll delete all NAs to have a clean dataset.

# Compute ATR And nLoss variable

pd_data["xATR"] = talib.ATR(pd_data["High"], pd_data["Low"], pd_data["Close"], timeperiod=ATR_PERIOD)

pd_data["nLoss"] = SENSITIVITY * pd_data["xATR"]

#Drop all rows that have nan, X first depending on the ATR preiod for the moving average

pd_data = pd_data.dropna()

pd_data = pd_data.reset_index()

Next here is a function and a loop I’m using to compute ATRTrailingStop variable. It’s not the most efficient way to do that, but it 1 to 1 replicated logic from TradingView. I’ll take a look later how it can be computed without the loop.

# Function to compute ATRTrailingStop

def xATRTrailingStop_func(close, prev_close, prev_atr, nloss):

if close > prev_atr and prev_close > prev_atr:

return max(prev_atr, close - nloss)

elif close < prev_atr and prev_close < prev_atr:

return min(prev_atr, close + nloss)

elif close > prev_atr:

return close - nloss

else:

return close + nloss

# Filling ATRTrailingStop Variable

pd_data["ATRTrailingStop"] = [0.0] + [np.nan for i in range(len(pd_data) - 1)]

for i in range(1, len(pd_data)):

pd_data.loc[i, "ATRTrailingStop"] = xATRTrailingStop_func(

pd_data.loc[i, "Close"],

pd_data.loc[i - 1, "Close"],

pd_data.loc[i - 1, "ATRTrailingStop"],

pd_data.loc[i, "nLoss"],

)

In the following code I’ll compute “Buy” and “Sell” signals for my UT BOT Strategy:

# Calculating signals

ema = vbt.MA.run(pd_data["Close"], 1, short_name='EMA', ewm=True)

pd_data["Above"] = ema.ma_crossed_above(pd_data["ATRTrailingStop"])

pd_data["Below"] = ema.ma_crossed_below(pd_data["ATRTrailingStop"])

pd_data["Buy"] = (pd_data["Close"] > pd_data["ATRTrailingStop"]) & (pd_data["Above"]==True)

pd_data["Sell"] = (pd_data["Close"] < pd_data["ATRTrailingStop"]) & (pd_data["Below"]==True)

Next we’re ready to run the strategy itself:

# Run the strategy

pf = vbt.Portfolio.from_signals(

pd_data["Close"],

entries=pd_data["Buy"],

short_entries=pd_data["Sell"],

upon_opposite_entry='ReverseReduce',

freq = "d"

)

To check the stats we can use stats() method:

pf.stats()

These will output us following stats for BTCUSDT 1d timeframe:

Start 0 End 1808 Period 1809 days 00:00:00 Start Value 100.0 End Value 311.947976 Total Return [%] 211.947976 Benchmark Return [%] 435.91175 Max Gross Exposure [%] 100.0 Total Fees Paid 0.0 Max Drawdown [%] 60.805122 Max Drawdown Duration 774 days 00:00:00 Total Trades 198 Total Closed Trades 197 Total Open Trades 1 Open Trade PnL 1.963699 Win Rate [%] 35.532995 Best Trade [%] 126.663976 Worst Trade [%] -21.189107 Avg Winning Trade [%] 15.214053 Avg Losing Trade [%] -5.996914 Avg Winning Trade Duration 14 days 20:54:51.428571428 Avg Losing Trade Duration 5 days 21:21:15.590551181 Profit Factor 1.096022 Expectancy 1.06591 Sharpe Ratio 0.672734 Calmar Ratio 0.424353 Omega Ratio 1.108914 Sortino Ratio 1.055846 dtype: object

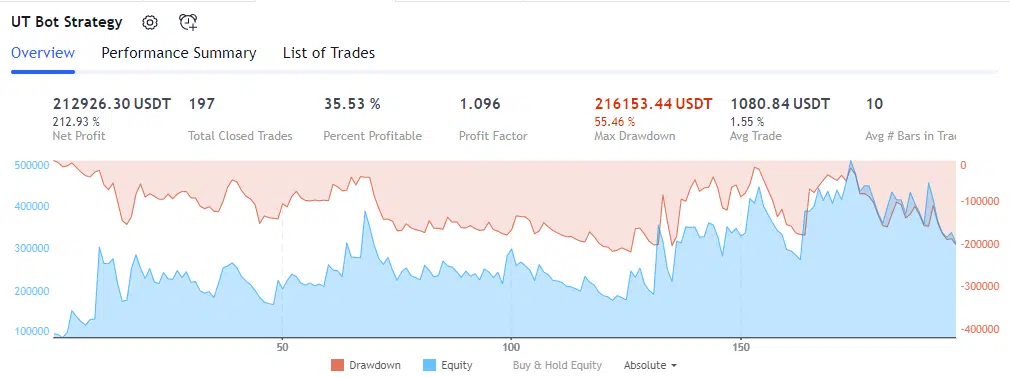

If we’re compare this metrics to TradingView’s metrics we’ll see that we’re matching exactly, this means that we implemented strategy correctly:

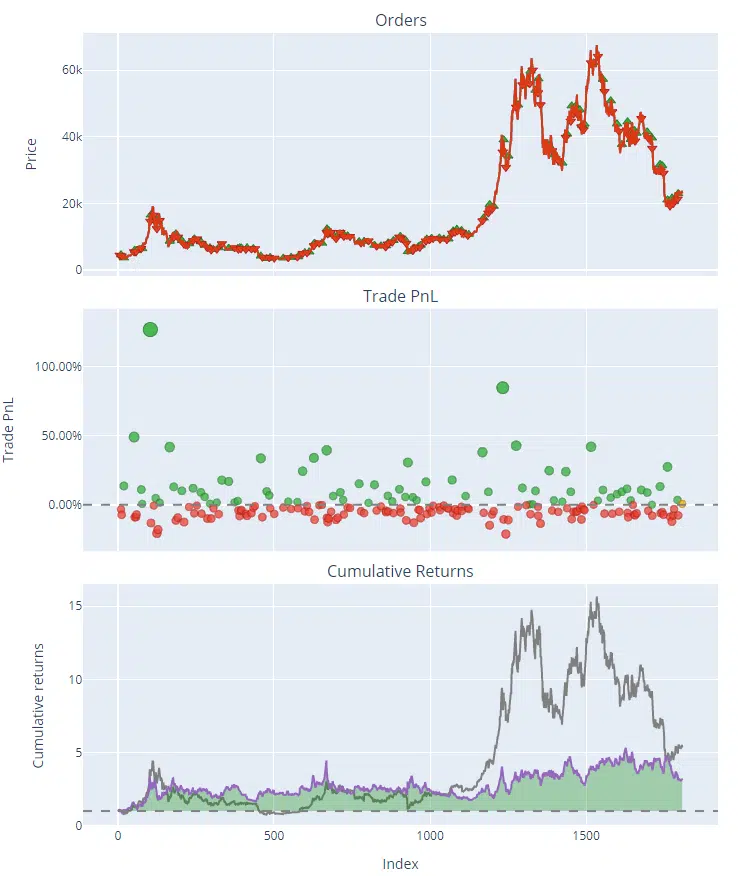

To plot the chart with P&L/signals and trades you can use following code:

# Show the chart

fig = pf.plot(subplots=['orders','trade_pnl','cum_returns'])

ema.ma.vbt.plot(fig=fig)

fig.show()

As you can see it’s not very complicated to code in Python even pretty advanced strategies like UT BOT. If you want me to implement other strategies in Python – let me know.

Follow me on TradingView and YouTube.

Awesome. I’d bet your profitability would be much better on an instrument with less abrupt price swings, like a stock or forex pair.

ERROR: Could not find a version that satisfies the requirement apis (from versions: none)

It’s a custom code to get data from Binance, here is this function:

URL = 'https://api.binance.com/api/v3/klines'

intervals_to_secs = {

'1m':60,

'3m':180,

'5m':300,

'15m':900,

'30m':1800,

'1h':3600,

'2h':7200,

'4h':14400,

'6h':21600,

'8h':28800,

'12h':43200,

'1d':86400,

'3d':259200,

'1w':604800,

'1M':2592000

}

def download_kline_data(start: dt.datetime, end:dt.datetime ,ticker:str, interval:str)-> pd.DataFrame:

start = int(start.timestamp()*1000)

end = int(end.timestamp()*1000)

full_data = pd.DataFrame()

while start < end: par = {'symbol': ticker, 'interval': interval, 'startTime': str(start), 'endTime': str(end), 'limit':1000} data = pd.DataFrame(json.loads(requests.get(URL, params= par).text)) data.index = [dt.datetime.fromtimestamp(x/1000.0) for x in data.iloc[:,0]] data=data.astype(float) full_data = pd.concat([full_data,data]) start+=intervals_to_secs[interval]*1000*1000 full_data.columns = ['Datetime', 'Open', 'High', 'Low', 'Close', 'Volume','Close_time', 'Qav', 'Num_trades','Taker_base_vol', 'Taker_quote_vol', 'Ignore'] return full_data

TA-Lib library not availble

Hi John,

You can install it in python: https://pypi.org/project/TA-Lib/

So.. one question, I’m trying to implement it not as a backtest, but live. I just cannot find the take-profit and stoploss in the code, only the ATRtrailingstop which is used to indicate when/whether to buy and sell.

When the buy/sell signal is produced, how would you determine the SL/TP?

Thanks in advance!

Joy

Check SL/PT examples here: https://quantnomad.com/using-sl-and-pt-in-backtesting-in-python-with-vectrobt/

Thank you, I got it. After executing your code, whole copy paste directly the output is not same or wrong.

tart 0

End 2403

Period 2404 days 00:00:00

Start Value 100.0

End Value -1817.297673

Total Return [%] -1917.297673

Benchmark Return [%] 1518.093694

Max Gross Exposure [%] 100.0

Total Fees Paid 0.0

Max Drawdown [%] 674.045678

Max Drawdown Duration 2301 days 00:00:00

Total Trades 31

Total Closed Trades 30

Total Open Trades 1

Open Trade PnL -2036.013137

Win Rate [%] 43.333333

Best Trade [%] 126.663976

Worst Trade [%] -20.708764

Avg Winning Trade [%] 22.977098

Avg Losing Trade [%] -8.584429

Avg Winning Trade Duration 14 days 14:46:09.230769230

Avg Losing Trade Duration 5 days 08:28:14.117647058

Profit Factor 1.363926

Expectancy 3.957182

Sharpe Ratio -0.513601

Calmar Ratio NaN

Omega Ratio 0.632677

Sortino Ratio -0.527403

dtype: object

Make sure you have the same data

The data is same, copy paste every thing.

Do you think is there any mistake in my program?

import vectorbt as vbt

import pandas as pd

import numpy as np

import talib

import datetime as dt

import requests

import json

import binance

URL = ‘https://api.binance.com/api/v3/klines’

intervals_to_secs = {

‘1m’: 60,

‘3m’: 180,

‘5m’: 300,

’15m’: 900,

’30m’: 1800,

‘1h’: 3600,

‘2h’: 7200,

‘4h’: 14400,

‘6h’: 21600,

‘8h’: 28800,

’12h’: 43200,

‘1d’: 86400,

‘3d’: 259200,

‘1w’: 604800,

‘1M’: 2592000

}

def download_kline_data(start: dt.datetime, end: dt.datetime, ticker: str, interval: str) -> pd.DataFrame:

start = int(start.timestamp() * 1000)

end = int(end.timestamp() * 1000)

full_data = pd.DataFrame()

while start prev_atr and prev_close > prev_atr:

return max(prev_atr, close – nloss)

elif close < prev_atr and prev_close prev_atr:

return close – nloss

else:

return close + nloss

# Filling ATRTrailingStop Variable

pd_data[“ATRTrailingStop”] = [0.0] + [np.nan for i in range(len(pd_data) – 1)]

for i in range(1, len(pd_data)):

pd_data.loc[i, “ATRTrailingStop”] = xATRTrailingStop_func(

pd_data.loc[i, “Close”],

pd_data.loc[i – 1, “Close”],

pd_data.loc[i – 1, “ATRTrailingStop”],

pd_data.loc[i, “nLoss”],

)

# Calculating signals

ema = vbt.MA.run(pd_data[“Close”], 1, short_name=’EMA’, ewm=True)

pd_data[“Above”] = ema.ma_crossed_above(pd_data[“ATRTrailingStop”])

pd_data[“Below”] = ema.ma_crossed_below(pd_data[“ATRTrailingStop”])

pd_data[“Buy”] = (pd_data[“Close”] > pd_data[“ATRTrailingStop”]) & pd_data[“Above”]

pd_data[“Sell”] = (pd_data[“Close”] < pd_data["ATRTrailingStop"]) & pd_data["Below"]

# Run the strategy

pf = vbt.Portfolio.from_signals(

pd_data["Close"],

entries=pd_data["Buy"],

short_entries=pd_data["Sell"],

upon_opposite_entry='ReverseReduce',

freq="d"

)

# print(pf.stats())

pf.stats()

# Show the chart

fig = pf.plot(subplots=['orders', 'trade_pnl', 'cum_returns'])

ema.ma.vbt.plot(fig=fig)

fig.show()

Awesome . Were you able to find a way to calculate the ATRTrailingStop variables without using the loop?

Hi Federico,

I’m not sure it’s possible to do that with vector. It’s past dependant.

What is the mathematical algorithm that vectorbt uses to calculate the signals Above & Below?

# Calculating signals

ema = vbt.MA.run(pd_data[“Close”], 1, short_name=’EMA’, ewm=True)

pd_data[“Above”] = ema.ma_crossed_above(pd_data[“ATRTrailingStop”])

pd_data[“Below”] = ema.ma_crossed_below(pd_data[“ATRTrailingStop”])

Thank you in advance for your response!

Well, I think it’s simply if first value for previous bar was below the second value, but now it’s above.