vectorbt is the new Python Backtesting framework I’m using these days. I really like it so I decided to share an example of the simplest strategy built in the vecotrbt from scratch, so you can understand why I like it. This library is developed mostly in Pandas and Numpy so it should be really fast as well.

Let’s create a simple long only MA strategy. We’ll enter long when fast moving average cross over slow moving average and will close our position on the opposite cross.

Let’s start with importing the library:

import vectorbt as vbt

Next, I’ll download data from Yahoo Finance. There are many more other options, but for simplicity I’ll use build-in options for Yahoo finance:

data = vbt.YFData.download(

'AAPL',

interval = '1d'

)

This code will download daily OHLC data Apple stock for the entire history. In this backtest I’ll use only close data so I’ll create another variable with only close:

data_close = data.get('Close')

Next, let’s compute the moving averages we need for our signals. For that we can use build-in functions for moving average computations:

ma_fast = vbt.MA.run(data_close, 10)

ma_slow = vbt.MA.run(data_close, 50)

After MAs are computed we can create calculate our signals. Again I’ll use build-in functions for MA crosses:

entries = ma_fast.ma_crossed_above(ma_slow)

exits = ma_fast.ma_crossed_below(ma_slow)

Now we have everything to run our backtest, in our case I’ll use “from_signal” function from vectorbt:

res = vbt.Portfolio.from_signals(

data_close,

entries = entries,

exits = exits,

freq = 'd'

)

So now our backtest is computed, so let’s check performance and other metrics of our strategy. To get basic metrics you can use stats() method of your backtesting results object:

res.stats()

This will output the following metrics:

Start 1980-12-12 00:00:00+00:00 End 2022-08-05 00:00:00+00:00 Period 10501 days 00:00:00 Start Value 100.0 End Value 210757.880978 Total Return [%] 210657.880978 Benchmark Return [%] 165184.748186 Max Gross Exposure [%] 100.0 Total Fees Paid 0.0 Max Drawdown [%] 72.076296 Max Drawdown Duration 1512 days 00:00:00 Total Trades 128 Total Closed Trades 127 Total Open Trades 1 Open Trade PnL 19614.191557 Win Rate [%] 48.031496 Best Trade [%] 115.002703 Worst Trade [%] -55.651257 Avg Winning Trade [%] 25.743169 Avg Losing Trade [%] -7.004448 Avg Winning Trade Duration 79 days 19:16:43.278688524 Avg Losing Trade Duration 21 days 09:05:27.272727272 Profit Factor 3.360768 Expectancy 1504.281019 Sharpe Ratio 0.883608 Calmar Ratio 0.422827 Omega Ratio 1.191955 Sortino Ratio 1.300257 dtype: object

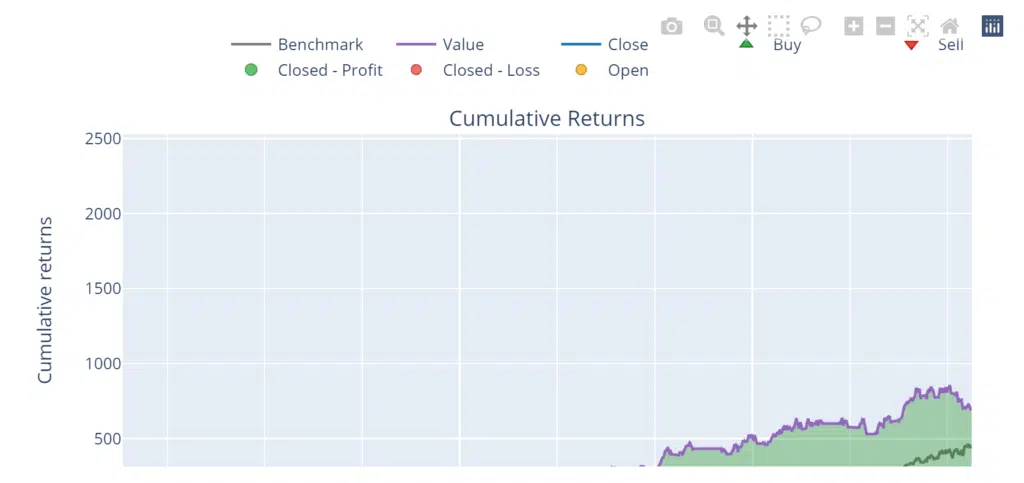

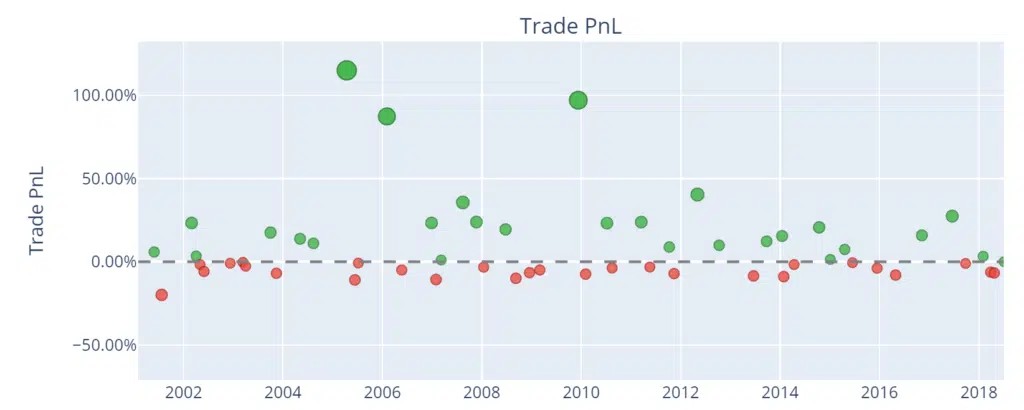

It’s quite easy to plot nice charts with metrics and signals. For that, you can use the plot() method specifying what plots you want to compute over the backtesting results.

fig = res.plot(subplots = ['cum_returns', 'orders', 'trade_pnl'])

fig.show()

This will output you 3 plots. All these plots will be dynamic plots built with plotly, so you can zoom on it, explore details, etc.

If you want a bit more details about your strategy you can get a detailed summary of your trades:

res.positions.records_readable

This code will output you a nice pandas data frame with some metrics for all your trades:

So that’s it, As you can see it’s a really nice library that will allow you to code backtests and explore your strategies just in a few lines of code. I think I’ll create more content about it, so let me know what you want to know about it.

Here is full code used in this article:

import vectorbt as vbt

data = vbt.YFData.download(

'AAPL',

interval = '1d'

)

data_close = data.get('Close')

ma_fast = vbt.MA.run(data_close, 10)

ma_slow = vbt.MA.run(data_close, 50)

entries = ma_fast.ma_crossed_above(ma_slow)

exits = ma_fast.ma_crossed_below(ma_slow)

res = vbt.Portfolio.from_signals(

data_close,

entries = entries,

exits = exits,

freq = 'd'

)

res.stats()

fig = res.plot(subplots = ['cum_returns', 'orders', 'trade_pnl'])

fig.show()

res.positions.records_readable

Follow me on TradingView and YouTube.