The Buffet Indicator, named after the renowned investor Warren Buffett, is a financial metric used to gauge the overall valuation of the stock market relative to the economy. It is calculated by dividing the total market capitalisation of publicly traded stocks in a country by its Gross Domestic Product (GDP). Essentially, the Buffet Indicator compares the size of the stock market to the size of the economy. Warren Buffett has mentioned that this ratio can be a strong indicator of whether the stock market is overvalued, fairly valued, or undervalued compared to historical averages. A high ratio suggests that the market is overvalued relative to the economy, implying potential for future corrections, while a low ratio indicates that the market may be undervalued, potentially offering investment opportunities.

II recently developed a Buffet Indicator tailored for TradingView and made it available as an open-source tool for the broader trading community. This adaptation of the renowned Buffet Indicator leverages real-time market capitalization and Gross Domestic Product (GDP) data to provide TradingView users with a dynamic and insightful gauge of market valuation relative to the economy. By publishing it open-source, I aimed to empower traders and investors with a valuable resource for making informed decisions, fostering a culture of transparency and collaboration within the financial analysis community. This tool not only reflects my commitment to contributing to the collective knowledge base but also enhances the utility of TradingView as a platform for sophisticated market analysis.

You can find the indicator here: https://www.tradingview.com/script/1kCDQbIT-Buffett-Indicator/

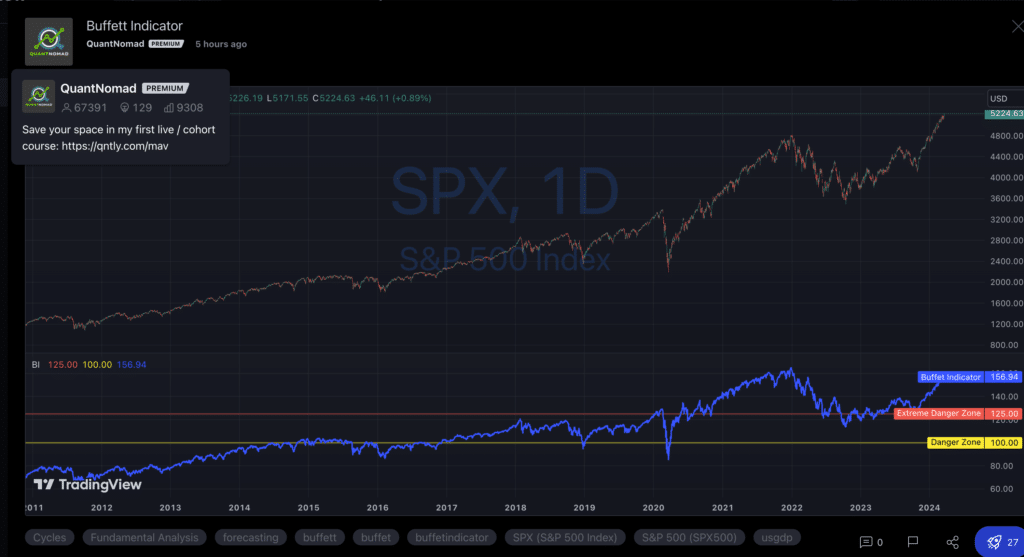

The Buffet Indicator has recently reached levels that are unexpectedly high compared to its historical averages, signaling an unusual divergence in the valuation of the stock market relative to the economy. This surge suggests that the market may be significantly overvalued, raising concerns among investors about the sustainability of current stock prices and the potential for future market corrections. The stark deviation from historical norms underscores the importance of cautious investment strategies and highlights the need for a deeper analysis of underlying market conditions and economic indicators.

I’I’m currently on the lookout for data to adapt and apply the Buffet Indicator to other country indexes, aiming to broaden the utility and applicability of this valuable tool across various global markets. This endeavor involves gathering comprehensive market capitalization and Gross Domestic Product (GDP) data for different countries, which can be quite challenging due to the diverse sources and varying availability of data. I’m hopeful that someone with access to such data or with experience in collecting it could offer their assistance. Collaborating with individuals or organisations that have insights or resources in this area would be incredibly beneficial, not only to the development of the indicator but also to the wider investment community seeking to apply the Buffet Indicator’s insights to international markets.